Prepare For The Future Of Marketing — Build Your Content Factory

There are few startups or young companies that doesn’t have a blog these days. We all know the benefits of producing content in one shape or another, but exactly how to do it the right way?

There are several ways to establish yourself as a quality content provider, and some things you need to avoid when interacting with people through content.

Build Credibility and expertise

Content marketing is more about showing of your knowledge, to help people, than to sell something.

A common mistake companies often do, is to produce their content like a very good-looking ad for their product. Wrong.

A blog article will usually never lead to a sale or a direct purchase, it’s about building credibility as an expert in your field. So when your potential customers is ready to make a purchase he or she knows what brand to trust with his wallet.

This means that you can’t fake being an expert if you really want to get something out of your content. This blog you’re reading right now is not existing for you to buy or invest anything in itnig.

We want to be a real resource for the startup community, so that our startups benefits from the reputation itnig has as a good provider of useful knowledge.

If you’re company full of experts or people with a lot of experience you should take advantage of their knowledge, and present it through your content.

If you’re a startup, with a young team without experience, you can bring in external people from your network, experts or others for an interview, but present it through your brand, so both you and your external expert benefit from it.

Stay Relevant

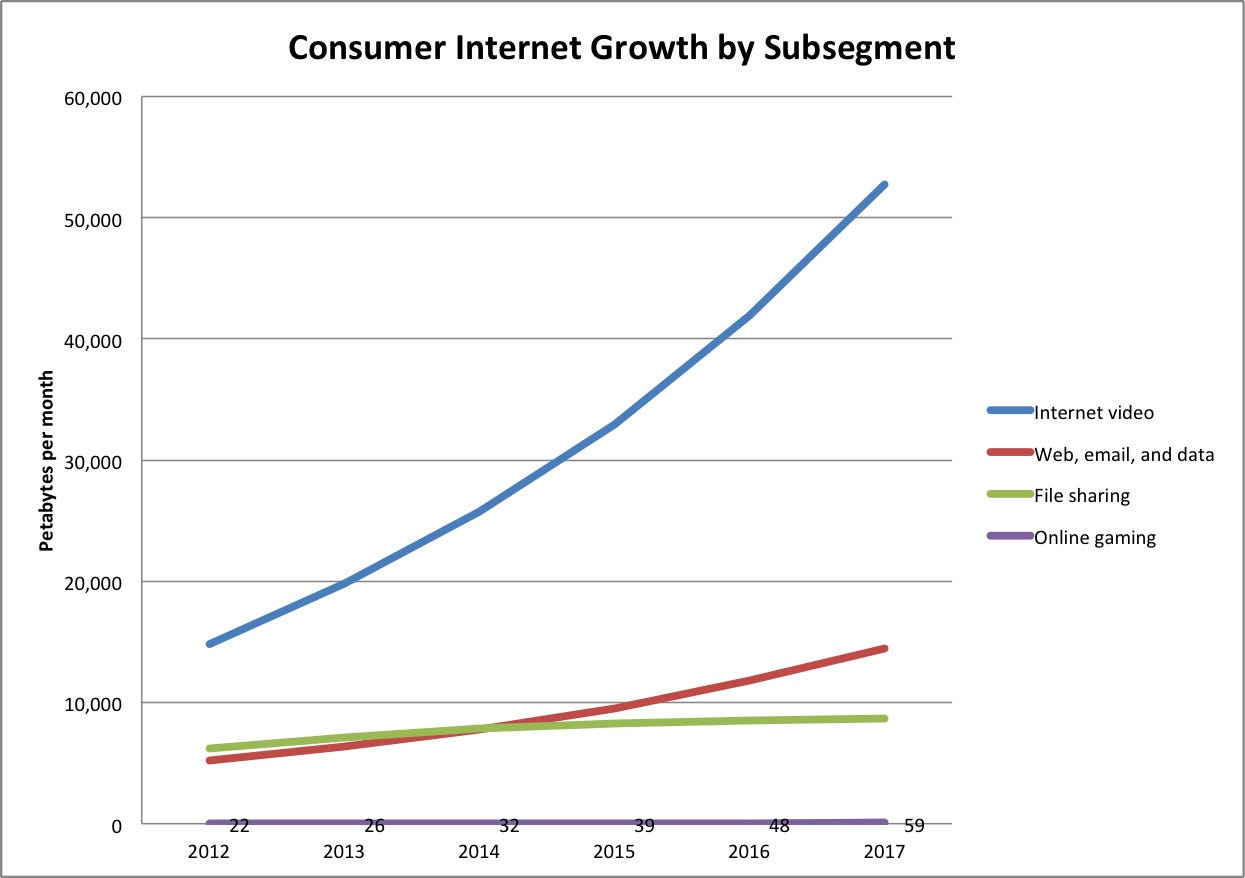

Staying in touch with trends is getting harder, as trends are changing every day.

One of the ways of staying in touch with what’s relevant for your audience is creating a balance of current and evergreen content.

To only cover current trends is great when it’s hyped, but it’s a big risk to take if it fades away in a month or two. In other words, many hours of hard work can be wasted. To stay relevant you also need to present evergreen content; videos & posts that explain timeless topics which have been discussed, and will be discussed for the next ten years:

All of these articles are evergreen, and will bring people to the itnig blog for the next years. With a balance between this kind of content, and current events in the industry you’re in, you’ll be sure to create a brand that shines of relevance.

Avoid content shock

We are reaching a point in content marketing where publishing 500 word articles for SEO isn’t really working anymore.

As everyone is creating content we need to know our customers or users much better. Do the research, and instead of creating tons of short posts, create longer content with higher value. Also because Google now favors that kind of content. The average word count of a Google first page result is 1,890 words. Also Medium favor longer content, as a 7 minute read will rank better in their algorithms.

If you’re building or running a company I guess you spend a good amount of time getting to know your customers. Use this information to shape your content.

It’s however worth mentioning that if you’re doing video content, the rule of length does not apply as much as with written or audio content. If it’s not a super interesting keynote, try to keep it shorter, around 1–2 minutes, especially in social media.

Across platforms

There’s tons of places on the internet where you can promote your content.

Medium, Twitter, Facebook, Youtube, Snapchat, LinkedIn, the list goes on..

The key is again to know your customer and your content. All platforms has their target audience and one or more types of content that performs well. Medium is obviously good for text, especially longer form. Facebook and Youtube is great for video. Twitter is great for spreading the word fast.

Have you seen the itnig blog lately? It's full of great resources for you and your startup! https://t.co/XYUPFSkte7 pic.twitter.com/M2bJnjZ88t

— Itnig (@itnig) October 21, 2016

The different social media channels all serve their particular purpose, and you can’t stick to only one. When itnig writes a medium article we always try to include:

- Videos

- Photos

- Social media content

It should be a goal to do this in all posts, but it’s hard and resource demanding. It’s however these posts that people read and share the most.

Now, go build your own content factory!

…………………………..

This post was written by @sindre hopland, media manager at itnig, and based on Scott Mackin’s talk at itnig this fall.